Just because you can afford to buy a house doesn’t always mean you should. There are huge differences between renting a home and buying one. You should always evaluate your options and figure out which choice is the best fit for you.

There are several things you need to consider when making this decision. Are you looking to settle down with a family? What is your credit score like? Are you planning to move again within the next few years? It never hurts to be educated on the differences between renting and buying, so here are the three biggest ones you’ll need to know about.

1. Down payments vs. fixed price

If you choose to buy a house, this requires more money up front. This plays into the question, how much money do you have in the bank? Can you afford it? At least 20% of the asking price is needed for a down payment when buying a home. Otherwise, you may need to pay for mortgage insurance.

If that’s the path you’re going down, you might want to look into companies such as J.G. Wentworth for help with your finances for low rates and no points on refinances or new home loans. However, if you decide to rent a home, that simply requires a smaller, fixed amount each month. More Info On 2019’s Top Rated Home Loans 🏚.

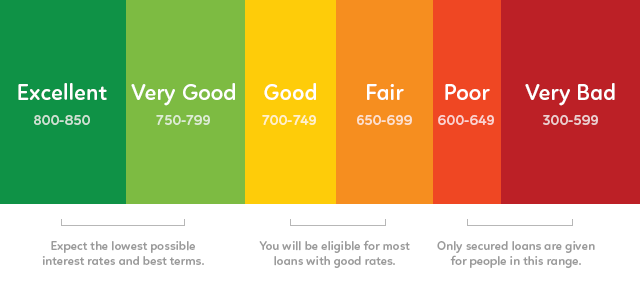

2. Your credit

Not only your credit matters, but your partner’s/spouse’s credit also matters. If your credit score is over the 700 range, you’re in good standing to get the best rates on a mortgage when buying a home. However, if you decide to rent with a credit score lower than 700, you’ll end up paying higher interest rates on a mortgage. Property managers will also take a look at your credit score history to ensure they can trust you to pay on time as one of their renters.

Again, when it comes to mortgages, it can be tough. Another company to look into when making these home-related decisions is Quicken Loans. They have different loan options available based on what you need. Find the lowest mortgage rates possible 🔎

3. Paying the bills

There are a few differences here. When buying a home, it may take years to pay off your mortgage, but it eventually eliminates the need for a monthly cost once paid. When renting a home, you will pay every month for as long as you live there. Additionally, unless you live in a rent-controlled building, that price will likely increase each year.

Need help paying off your mortgage? LendingTree is among the top online lending marketplace for those who want to save on their mortgage. It also has additional resources such as a payment calculator and an option to check and monitor your credit score for FREE.

Knowing all of the differences between renting and buying a home are absolutely crucial in the home-searching process. Hopefully, these 3 important differences will help you make the right decision!